BSE Achieves Record Revenue of Rs. 1,618 Crores, Up 70%

Share

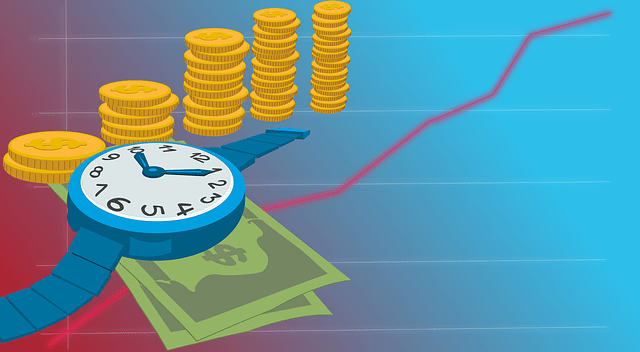

The cornerstone of BSE’s success was its record-breaking revenue of Rs 1,618 crores, marking a remarkable 70% growth trajectory. This surge in revenue was complemented by a robust consolidated net profit attributable to shareholders, reaching an impressive Rs. 410.9 crores.

BSE declares a Final Dividend of Rs 15 per equity share having face value of Rs 2 each for FY 2023-24.Consolidated Net profit attributable to the shareholders excluding CDSL Stake sale for the year ended March 31, 2024, stands at Rs. 410.9 crores.

Consolidated Operating EBITDA for the March 31, 2024, up by 103% to Rs. 399.9 crores from Rs. 197.4 crores in previous year, with EBITDA margin expanding to 29% from 24%.

For FY24, BSE traded 11.3 billion contracts in Equity Derivatives segment, since its relaunch on 15th May 2023, generating a total revenue of Rs. 176 crores.

Total number of transactions in BSE StAR MF grew by 55% to reach 41.1 crores transactions during FY 2024 from 26.5 crores last year, with BSE continuing a market share of 89%.

Commenting on the results, the MD & CEO, BSE said “I am happy to say that we have done well in our objective of a vibrant trading platform. We have created a strong portfolio of businesses, a rapid pace of innovation, and a strategy that is well understood. Now it’s time to widen and deepen our existing product offerings, and we feel that we are on the right track.”

Business Highlights – Primary Markets

BSE platforms continue to remain the preferred choice by Indian companies to raise capital. BSE platform has enabled issuers to raise Rs. 21.3 lakh crores by means of equity and debt, bonds, commercial papers, etc.

Trading Segments

The average daily turnover in equity cash segment stands at Rs. 6,622 crores compared to Rs. 4,132 crores in the previous year.

In less than one year since relaunch of Derivatives segment, BSE ranks second amongst exchanges globally and its flagship index, Sensex ranks 4th in terms of derivatives contracts traded, according to the data published by the Futures Industry Association (FIA).

On 3rd May 2024, more than 52 crores contracts of Sensex were traded representing a notional turnover of over Rs. 388 lakh crores and a premium turnover of Rs. 30,750 crores.

On Oct 16, 2023, Bankex created a new record with 19 crore contracts traded, representing a notional turnover of 160 lakh crores.

More than 400 members have traded BSE Derivatives representing more than 36 lakh UCCs.

Mutual Fund – StAR MF Platform

BSE StAR MF delivered yet another year of record revenues and performance, up 63% year-on-year to reach Rs. 128 crores.

The total number of transactions processed by BSE StAR MF grew by 55% to reach 41.1 crore transactions in FY24 from 26.5 crores in the previous year. BSE’s market share stands at 89% among exchange distributed platforms.

The BSE’s StAR MF has been consistently reaching new highs in terms of transactions with the platform processing a new high of 4.73 crore transaction in April 2024.

On an average, the platform processed 3.4 crore transactions per month in FY 2024 as compared to 2.2 crores in FY 2023.

Subsidiaries

S&P Dow Jones Indices LLC’s is in discussion with BSE for divestment of its equity stake in Asia Index Private Limited, a 50-50 joint venture with BSE. This will an important area of focus in the coming year.

The BSE group directly or via subsidiaries also has its presence in other related business including India International Exchange (India INX) – BSE’s Exchange at GIFT City, BSE Ebix, insurance distribution platform with Ebix Inc, The Hindustan Power Exchange (HPX) in association with PTC India and ICICI Bank, BSE E-Agricultural markets (BEAM), spot platform for trading in commodities and BSE Administration and Services Limited (BASL).

BSE is committed to these new areas and is constantly working with partners for the growth of these businesses. As we move forward, we see that there is a significant opportunity to continue to expand and evolve these businesses.

Audited Consolidated Financial Results at a Glance:

|

Particulars |

FY24 |

FY23 |

YoY Growth |

|

(Rs. Crore) |

(Rs. Crore) |

||

|

Total Revenue |

1,618 |

954 |

↑ 70% |

|

Revenue from Operations |

1,390 |

816 |

↑ 70% |

|

Less: Operating Expenses |

990 |

618 |

↑ 60% |

|

Operating EBIDTA |

400 |

197 |

↑ 103% |

|

Operating EBIDTA Margin |

29% |

24% |

|

|

Add: Other Income |

228 |

138 |

↑ 65% |

|

Less: Depreciation and Interest costs |

110 |

88 |

↑ 26% |

|

Profit before Tax and share of associates |

517 |

248 |

↑ 109% |

|

Add: Share of Profit of Associates |

72 |

49 |

↑ 46% |

|

Less: Taxes |

185 |

92 |

↑ 102% |

|

Net Profit |

404 |

206 |

↑ 97% |

|

Net Profit attributable to shareholders |

411 |

221 |

↑ 86% |